Today’s shoppers want options when it comes to how they pay, when they pay, and where they pay. Smart retailers are making sure their point-of-sale (POS) systems deliver payment flexibility and ease. How can you ensure your business stays one step ahead of customer preferences? Here’s a look at the latest payment trends.

What’s trending in retail payments?

As shopping habits and customer expectations continue to shift, retailers must be ready to adapt and deliver solutions that keep customers coming back – and attract new ones. Right now, many retailers are adjusting to the dramatic acceleration of e-commerce sales. Online retail sales jumped 44 percent in 2020 – the biggest increase in the last 20 years. And, even if e-commerce transactions level off a bit, there’s no denying that more customers are comfortable with online purchasing and expect their favorite retailers to offer seamless omnichannel shopping.

Trend #1: Digital payments

Along with the spike in e-commerce and “buy online pick up in-store” (BOPIS) shopping comes increased adoption of contactless, digital payment capabilities. These capabilities include tap-to-pay credit and debit cards, digital wallets, and mobile payments – which have officially replaced cash as the most used payment option.

Card issuers are pushing the adoption rate by touting the ease and security of adding their cards to a digital wallet. And apps like Apple Pay and Google Pay continue to add users. As a result, the number of digital wallet users and the money spent using the option are projected to nearly double by 2025.

Many retailers will need to play catch up. Today, nearly half are unable to accept mobile payments due to POS system constraints. Now’s the time to explore the scope of your POS payment capabilities and make changes, if needed. Even if your customers aren’t requesting digital and mobile payments quite yet, adding the option will pay off. Down the road, 68 percent of customers anticipate shopping more at stores that offer the convenience of paying via a digital wallet, and 57 percent say they expect to spend more money when they do.

Trend #2: Buy now, pay later.

Shoppers are also looking for flexibility when it comes to purchasing options, especially if it keeps them from accumulating credit card debt. And retailers are delivering with a range of creative, convenient options to help drive more sales. The ability for customers to buy a product today and defer part of the payment until later is gaining traction beyond big-ticket items.

One in five U.S. retailers offered buy now, pay later options, including deferred payments, layaway, and recurring billing, as of 2020. Just a year later, that number had increased to nearly one in two. At the same time, 36 percent of consumers reported using a buy now, pay later payment option.

Look for POS systems that enable you to create, track, and manage in-house accounts with functionality such as recurring billing, layaway, and even ongoing subscription purchases.

Related: 5 POS Promotions that Boost Retail Sales

Trend #3: Mobile POS

While online convenience is a trend, customers still want to combine e-commerce browsing with in-store shopping. In fact, 46 percent of people will choose in-person shopping over online if they have a choice. But they want a seamless experience no matter which way they shop. Retailers are adapting by adding the ease of mobile POS.

Mobile POS gives in-store sales associates the freedom to serve customers without being tied to a checkout desk. With mobile POS, a salesperson can answer customer questions, look up inventory details, or take payments from anywhere in the store using a mobile device, such as a tablet or smartphone. Mobile POS also puts customer data at the salesperson’s fingertips, which further personalizes the shopping experience and pays off for retailers. Customers are 40 percent more likely to spend more than they planned when their shopping experience is personalized.

Related: 8 Ways to Put the Wow in Your Point-of-Sale Experience

POSIM is a point-of-sale and inventory management system that’s designed to help keep up with the latest trends and deliver the payment flexibility and convenience customers want. Find out what’s possible with POSIM. Contact us for a demo today.

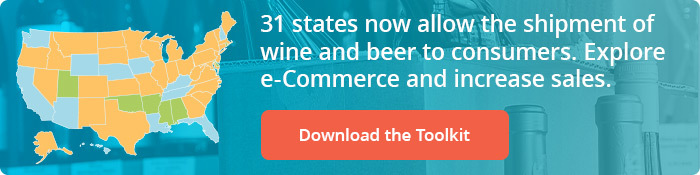

Are you interested in expanding customer relationships and increasing sales? Unpack our toolkit “A 6-Pack of Winning Strategies” – especially for retailers in the liquor market.